PERSONAL Loan Apply

In today's fast-paced world, financial stability and freedom have become essential goals for individuals and families alike. Whether you're dreaming of starting a business, planning a wedding, or facing unexpected medical expenses, personal loans can provide a lifeline when you need it most.

But before you jump into the world of borrowing, it's crucial to equip yourself with the necessary knowledge to make informed decisions. In this comprehensive guide, we'll explore everything you need to know about personal loans – from understanding the basics to finding the best loan options for your unique needs.

Join us as we unravel the mysteries of personal loans, debunk common myths, and provide valuable tips and insights to help you make the most of this financial tool. So, let's dive in and discover how personal loans can be your stepping stone towards financial freedom!

Apply to personal loan this bank.

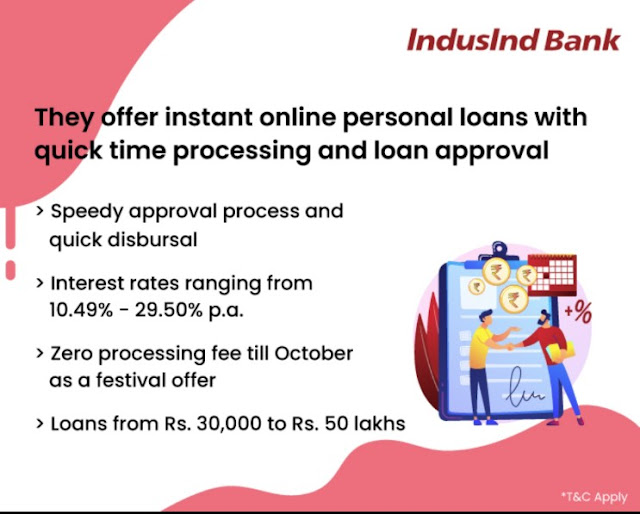

1. IndusInd Bank Personal Loan

Benefits of IndusInd BankPersonal

LoanLoan Amount ₹30,000 to ₹50 lakhTenure12 to 60 monthsApplication Process

●100% Online

●Minimal documentation

APPLY NOW

*Eligibility Criteria Salaried

❏Age Group: 18 - 55 Years

❏Income Range: ₹11,000+

❏Documents Required:

●Identity proof: Any one of the documents - Passport, PANCard, Ration Card, Aadhaar Card, Voter ID Card, DrivingLicence

●Address proof: Any one of the documents - Telephone bill,Electricity bill, Passport, Ration card, Rental agreement,Aadhaar card

●Income Proof: Salary certificate, Recent salary slip,Employment letter

APPLY NOW

*.Eligibility Criteria Self-employed

❏Age Group: 25- 60 Years

❏Income Range: ₹25,000+

❏Documents Required:

●Identity proof:Any one of the documents - Passport, PAN Card,Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

●Address proof:Any one of the documents - Telephone bill, Electricitybill, Passport, Ration card, Rental agreement, Aadhaar card

●Income Proof: Certified financials, Recent ITR (Income Tax Returns),Audited profit and loss statement or balance sheet.

APPLY NOW

2.Privo Instant Loan

Benefits of Privo InstantLoanLoan Amount

●₹20,000 to ₹2 lakhTenure

●3 to 60 monthsApplication Process

●100% Online

●Minimal documentation

Disbursal

●Instant approval &quick disbursal

Others

●No Processing fees

●No Pre Closure fees

●Forever exclusive access toall features

●Personalized Welcome Kit

●₹500 Amazon voucher

Interest Rates

●13.49% to 29.99%

Eligibility Criteria Salaried

●Age Group: 21 - 57 years

●Income Range: ₹18,000+

●Documents Required:

●Identity proof:Any one of the documents - PAN Card, RationCard, Aadhaar Card, Voter ID Card, Driving Licence

●Address proof:Any one of the documents - Aadhaar card,passport, Voter ID Card

●Income Proof: Salary certificate, Recent salary slip,Employment letter

3.KreditBee Instant Loan

Benefits of KreditBee Instant Loan

Tenure

Loan Amount

●₹1000 to ₹4 lakh

●From 64 days to 24 monthsLoan Amount

●₹1000 to ₹4 lakh Application Process

●100% Online

●No paperwork is required

●Minimal Documentation

Benefits of KreditBee Instant Loan

Disbursal

●10 Minute Disbursal

●Get the loan amount directly into bank accountOthers

●Easy repayment options

●No collateral required

●Purchase on EMI

Interest Rates

●15% to 29.95% per annum

Eligibility Criteria Salaried

❏Age Group: 21 - 55 years

❏Income Range: ₹8,000+

❏Documents Required:

●Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

●Address proof: Any one of the documents - Aadhaar card, passport, Voter ID Card

●Income Proof: Salary certificate, Recent salary slip, Employment letter

Eligibility Criteria Self-employed❏Age Group: 21 - 55 years

❏Income Range: You must have a regular source of income

❏Documents Required:

●Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

●Address proof: Any one of the documents - Aadhaar card, passport, Voter ID Card

●Business Proof: Proof of Business Existence, Certificate of Incorporation, Certificate of Registration with Appropriate Registration Body

●Income Proof: ITR of Past 2 years, Certified Profit and Loss Statement

4.Fibe Instant Loan

Benefits of Fibe Instant Loan

Tenure

●Upto 36 monthsLoan Amount

●₹5000 to ₹5 lakhApplication Process

Ten

●100% Online

●No paperwork is required

Interest Rates

●15% per annum onwardsDisbursal

●10 Minute Disbursal

●Get the loan amount directly into bank accountOthers

●Available 24X7

●No pre-closure fee

Eligibility Criteria Salaried

❏Age Group: 21 - 55 years

❏Income Range: ₹15,000 to ₹18,000

❏Documents Required:

●Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

APPLY NOW●Address proof: Any one of the documents - Aadhaar card, passport, Voter ID Card

●Income Proof: Salary certificate, Recent salary slip, Employment letter

Amount●₹1000 to ₹4 lakh Application Process●1% Online●No paperwork is required●Minimal D

Comments

Post a Comment